Capital alone doesn’t change the world. How you use it does. We manage over USD 1 billion with one goal: to deliver impact with long-term value. We invest where it matters most: finance, food systems and water.

Impact investing still accounts for less than 1% of global assets under management. We aim higher—because transforming systems takes more than capital. It takes commitment.

Impact starts here

This is what USD 4,8 billion in investments has achieved since inception. More importantly? What that capital does:

520 investees

reached across 76+ countries - since 1992

34.5 million+

people gained access to financial services, with a majority being women - in 2024

4.5 billion liters

of safe, affordable drinking water has reached 8.4 million low-income people - in 2024

584,050

smallholder farmers have grown more sustainably on 1.5 million hectares of land - in 2024

170+

projects have delivered technical assistance, ensuring capital drives long-term impact - since 1992

And there’s more.

More than ESG compliance—

a commitment to change

Our impact measurement and management system goes beyond checking boxes. We invest in businesses that drive meaningful change and hold ourselves accountable for measuring this change at every investment stage.

01

Investing with intent

Each fund begins with a clear theory of change and eligibility criteria. We screen out harmful practices – like child labor, unsustainable operations, or predatory lending- while seeking high-potential businesses aligned with our mission. Every investment must demonstrate a measurable impact.

02

Due diligence that assesses what matters

Our ESG analysis goes beyond compliance to drive real value. Using on-site audits and proprietary scoring, we require every investment to meet at least a 55% ESG score – because impact requires more than good intentions. Our approach aligns with leading global standards for responsible investment and sustainable agriculture.

03

Data-driven impact management

We provide quarterly reports, and we don’t make claims without proof. Through our proprietary web-based platform ECHOS 2.0©, we track impact metrics, ensuring transparency for investors, regulators, and, most importantly, the communities we serve.

03

Exits that leave a legacy

Our responsibility doesn’t end when we divest. We ensure that the businesses we invest in remain resilient, delivering sustainable financial and social outcomes long after our capital moves on.

Go beyond with us

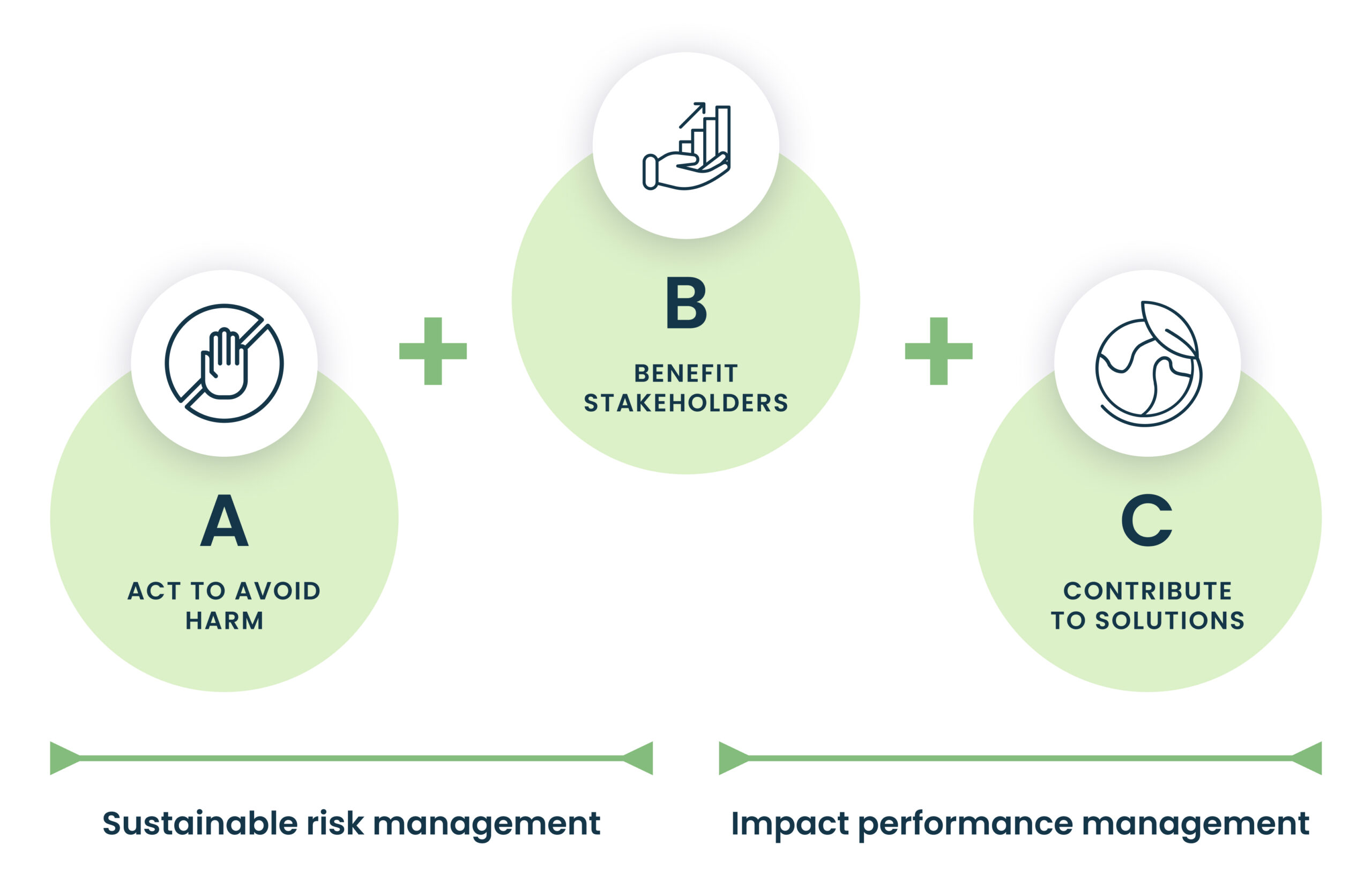

Many investors seek just to ‘avoid harm’, which means that they don’t invest in certain sectors like fossil fuels, weapons or tobacco.

Incofin goes beyond simply avoiding harm. We vigorously take measures to benefit our stakeholders and actively contribute to solutions.

Technical assistance

to strengthen impact

€10M Deployed | 9 TA Facilities | 170 Projects | 50+ Countries

Beyond our investment, Incofin provides businesses with the tools, expertise, and resources to scale their impact. We call this technical assistance, and it makes a world of difference.

Climate resilience for smallholder farmers in Nicaragua

Challenge: Increasingly unpredictable droughts and floods threatened the livelihoods of smallholder farmers.

Solution: Incofin supported the launch of a satellite index-based agricultural insurance program to mitigate climate risks.

Impact:

- 17,800 farmers insured against climate risks

- 20% of insured farmers are women

- 90% of insured farmers operate on less than 10 hectares

Partner: FUNDENUSE, MICREDITO, FUNDESER

Sustainable agriculture in the Democratic Republic of Congo

Challenge: Smallholder coffee farmers lacked access to modern agricultural training, impacting productivity and sustainability.

Solution: Incofin facilitated the establishment of demonstration farms and training programs.

Impact:

- 36 demonstration plots established

- 4 shade tree nurseries set up

- 1,063 new Fairtrade and Organic certifications in progress

Partner: SOPACDI

Agricultural practices for Vietnamese coffee farmers

Challenge: Securing supply of coffee for each harvest and avoiding value–chain disruption related to EUDR.

Solution: Increasing the loyalty of farmers by supporting them in getting Rainforest Alliance and 4C certification.

Impact:

- 1,150 farmers have implemented sustainable agricultural practices and are certified

- 39 staff members trained on Rainforest Alliance and 4C certification

Partner: Detech Coffee

Contributing to the movement

Change-making organisations and people are leading a global movement for impact investing. We’re at the front lines with them, celebrating the good achieved and striving for more.

Operating Principles for Impact Management (OPIM)

A key global standard: Incofin is a founding signatory. We reaffirm alignment each year through Disclosure and Verification statements.

2025 Disclosure Verification

2X Global

2X Global is an industry body for gender lens investing which brings together investors that promote investment practices that benefit women.

See more

Amazonia Finance Network

Supports inclusive, sustainable finance initiatives that protect the Amazon and improve the livelihoods of local communities.

See more

Council on Smallholder Agricultural Finance

A network focused on increasing the availability and effectiveness of financing for smallholder farmers globally.

See more

Impact Europe

A European impact investing network that aims to strengthen the ecosystem by connecting and supporting impact investors.

See moreThe Smallholder and Agri-SME Finance and Investment Network

A global network catalyzing partnerships and solutions to scale finance for agri-SMEs and rural development.

See more

Impact Finance Belgium

Works to connect Belgian impact investors and foster a more collaborative and aligned impact finance ecosystem.

See more

Global Impact Investing Network (GIIN)

A network dedicated to collaboration, research, and tools that strengthen the global impact investing community.

See more

Finance for Biodiversity

A collaborative of financial institutions committed to halting and reversing biodiversity loss through investment decisions and active ownership.

See more

Cerise+SPTF

Develops social performance management standards and tools that help inclusive finance actors align with responsible practices. It now includes the Financial Inclusion Equity Council.

See morePYM – the conscious investors’ community

Unites impact-driven wealthy individuals across Europe to invest consciously for a better world.

See moreBelgo-Indian Chamber of Commerce and Industry

Brings together Belgian stakeholders to unlock private capital for climate-positive and resilient investments.

See more

Private Capital Belgium

Connects private capital stakeholders in Belgium to drive sustainable investment and development impact. Incofin is part of the ESG committee.

See more

Women in Finance Belgium

Promotes gender equality in the finance industry by raising awareness, collecting data, and promoting concrete actions.

See moreInvestors & Partners

We’re proud to work with a diverse network of global partners who share our values and commitments.

Private Banks

Leading financial institutions from Germany and Belgium actively investing in our funds.

BNP Paribas Fortis | Belfius | KBC | vdk bank

Development Finance Institutions (DFIs) & Governments

A strong network of development banks and government-backed financial institutions driving sustainable investments worldwide.

European Investment Bank (EIB) | IFC (World Bank) | KfW | BII | FMO | PROPARCO | DFC | USAID | Impact Fund Denmark | SIDBI | IDB | EDFI MC

Institutional Investors & Corporates

Pension funds, asset managers, and corporations supporting impact-driven investments.

DPAM | Korys | Green Arrow Capital | Danone | Aqua for All | Volksvermogen

Industry Bodies & Foundations

Strategic partnerships with global organizations shaping the future of sustainable finance.

Fairtrade International | Global Alliance for Improved Nutrition (GAIN) | King Baudouin Foundation

Advisors to Microfinance Investment Funds

Trusted advisors to some of the world’s leading microfinance investment funds.

Invest in Visions (IIV) | Microfinance Enhancement Facility (MEF) | Global Gender-Smart Fund (GGSF)

Retail Investors

~2300 private individuals who believe in the power of impact-driven finance.